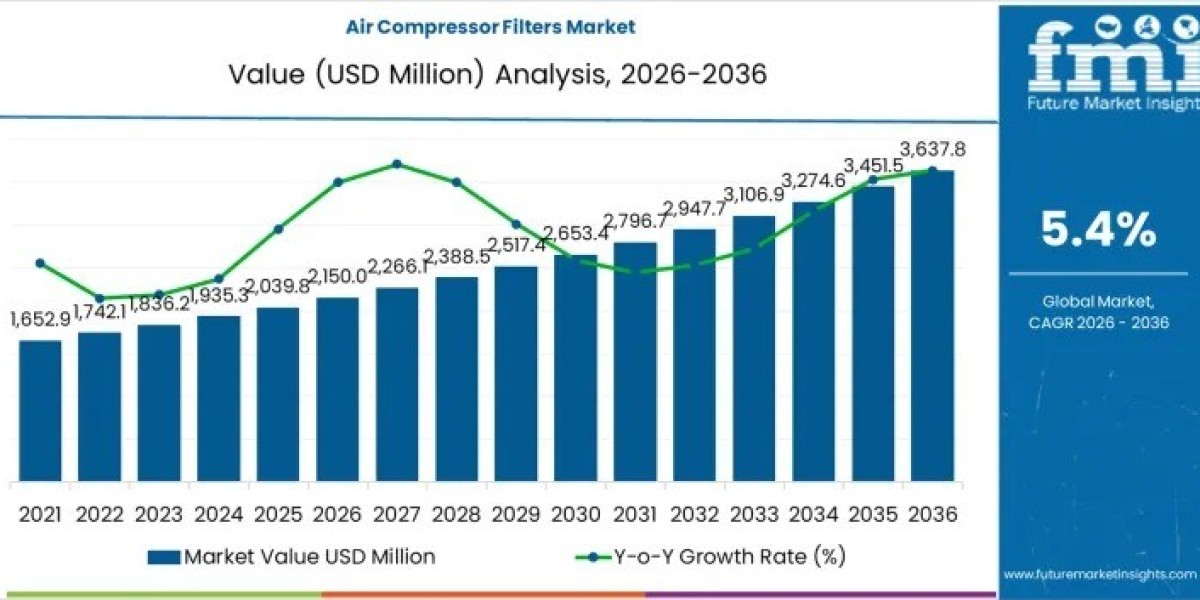

The Air Compressor Filters Market is projected to grow from USD 2,150.0 million in 2026 to USD 3,637.8 million by 2036, registering a CAGR of 5.4% during the forecast period. Market expansion is increasingly shaped by operational efficiency, replacement economics, and lifecycle value rather than aggressive shipment growth.

Compressed air systems are among the most energy-intensive utilities in industrial operations. Even small inefficiencies caused by poor filtration directly translate into higher power consumption and operating costs. As a result, end users are prioritizing filters that deliver lower pressure drop, longer service intervals, and stable performance, enabling suppliers to maintain pricing power through measurable value delivery.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-30975

Key Market Metrics at a Glance

- Market Value (2026): USD 2,150.0 Million

- Forecast Value (2036): USD 3,637.8 Million

- Forecast CAGR (2026–2036): 5.40%

- Leading Compressor Type: Rotary Screw

- Largest End Use: Manufacturing

- Key Growth Regions: Asia Pacific, North America, Middle East & Africa

Why Energy Efficiency Is Reshaping Filter Demand

Energy efficiency has emerged as a decisive purchasing factor across industrial filtration systems. Pressure loss caused by clogged or low-quality filters leads to higher compressor workload and increased electricity costs. This has shifted buyer focus toward high-performance filter media and advanced pleating designs.

Key efficiency-driven trends include:

- Adoption of high-efficiency coalescing and particulate filters

- Demand for extended replacement intervals

- Increased evaluation of total cost of ownership (TCO) rather than unit price

- Preference for filters validated for OEM performance standards

Buyer Behavior: Risk Aversion and Vendor Lock-In

Industrial buyers exhibit strong risk aversion when selecting air compressor filters. Filtration failure can result in:

- Equipment damage

- Production downtime

- Product contamination

- Regulatory non-compliance

As a result, OEM-specified and certified aftermarket filters dominate purchasing decisions. This behavior reinforces vendor lock-in, raises switching costs, and concentrates margins among suppliers capable of guaranteeing reliability and performance assurance. Between 2026 and 2036, value capture is expected to favor companies monetizing replacement cycles, preventive maintenance programs, and energy savings rather than volume-based pricing strategies.

Segment Analysis: Continuous-Duty Applications Drive Demand

Rotary screw compressors account for approximately 56% of market demand, reflecting their widespread use in continuous-operation industrial environments. These compressors generate high airflow volumes and require multi-stage filtration systems, including intake, oil, and air-oil separator filters, leading to higher filter consumption.

From an end-use perspective, manufacturing represents nearly 34% of total demand, supported by:

- Heavy use of pneumatic tools and automation

- High sensitivity to air contamination

- Strong emphasis on equipment uptime and product quality

Industries such as automotive, electronics, food processing, and general manufacturing continue to reinforce recurring demand through scheduled filter replacement practices.

Technology Advancements Supporting Market Expansion

Technological innovation remains central to market competitiveness. Suppliers are investing in:

- Advanced filter media with higher dust-holding capacity

- Designs optimized for minimal pressure loss

- Modular filter systems for ease of replacement

- Solutions aligned with oil-free and high-pressure compressors

Preventive maintenance adoption is also strengthening recurring demand, as industrial users increasingly follow structured replacement schedules to avoid unplanned shutdowns and efficiency losses.

Regional Growth Outlook: Emerging Markets Lead Momentum

The market shows strong regional momentum across industrializing economies:

- India (6.8% CAGR): Manufacturing expansion, dust-heavy environments, and preventive maintenance adoption

- Vietnam (6.4% CAGR): Export-oriented manufacturing and humidity-driven filtration needs

- Indonesia (6.1% CAGR): Growth in heavy industry, mining, and infrastructure

- Mexico (5.7% CAGR): Automotive and electronics manufacturing growth

- Saudi Arabia (5.2% CAGR): Harsh operating conditions across oil & gas and construction sectors

Competitive Landscape: Performance and Lifecycle Value Take Priority

Competition in the air compressor filters market is defined by filtration efficiency, service life, and compatibility across compressor platforms. Leading players include:

- Atlas Copco

- Ingersoll Rand

- Donaldson Company

- Parker Hannifin

- MANN+HUMMEL

- Sullair (Hitachi)

- Kaeser Kompressoren

- CompAir (Gardner Denver)

- FS-Curtis

OEM-integrated suppliers benefit from validated system compatibility, while filtration specialists differentiate through media innovation and cross-platform adaptability. Regional aftermarket brands compete on availability and pricing but face increasing pressure to match performance benchmarks.

Market Outlook: Stable, Replacement-Led Growth Ahead

The air compressor filters market is expected to maintain steady, value-led growth through 2036, supported by energy efficiency priorities, preventive maintenance strategies, and expanding industrial automation. Filters are increasingly viewed as strategic components that protect assets, control costs, and sustain production reliability.