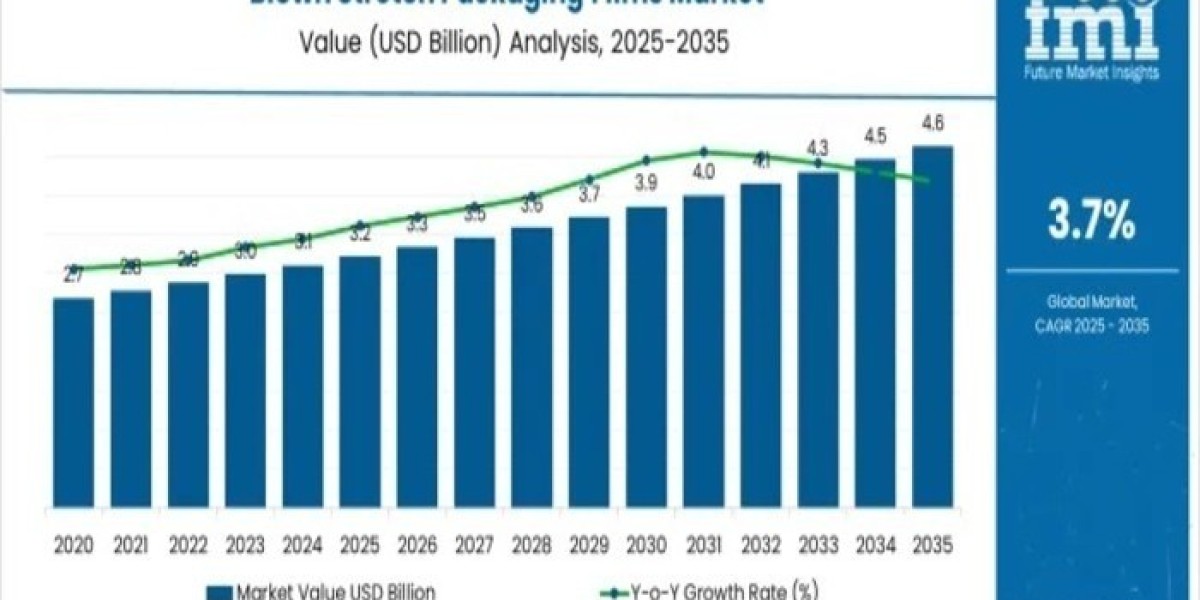

The global Blown Stretch Packaging Films Market is entering a decade of structured, innovation-driven growth, rising from USD 3.2 billion in 2025 to USD 4.6 billion by 2035, at a CAGR of 3.7%. With increasing demands for secure, sustainable, and efficient packaging across logistics, e-commerce, food and beverage, and industrial sectors, both long-established manufacturers and next-generation producers are reshaping the competitive landscape with advanced film technologies and eco-focused product lines.

Market Overview: Growing Demand for Secure Palletization and High-performance Films

The market has steadily evolved over the past decade, expanding from USD 2.7 billion in 2021 to USD 3.2 billion in 2025. This growth has been fueled by rising adoption of stretch films for:

- Load stability and pallet security

- Improved warehousing and logistics efficiency

- Protection against moisture, dust, and contamination

- High-speed automated packaging lines

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates – https://www.futuremarketinsights.com/reports/sample/rep-gb-24652

During 2021–2025, the market registered incremental growth USD 2.8 billion (2022), USD 2.9 billion (2023), USD 3.0 billion (2024), and USD 3.1 billion (2025) reflecting consistent uptake of lightweight, high-performance blown films.

Looking ahead, 2026–2030 marks the next phase of expansion, with value rising to USD 3.9 billion driven by enhanced film strength, multi-layer co-extrusion, and material optimization. By 2035, the market is expected to achieve USD 4.6 billion, supported by the integration of automation and data-enabled packaging technologies.

Quick Stats

- Market Value (2025): USD 3.2 billion

- Market Forecast (2035): USD 4.6 billion

- CAGR (2025–2035): 3.7%

- Leading Segment (2025): Machine Stretch Film (56%)

- Top Regions: North America, Asia-Pacific, Europe

- Key Players: Berry Global, Amcor, Sealed Air, Sigma Plastics, AEP Industries

- Fastest-growing Countries: China (5.0%), India (4.6%), France (3.9%)

Market Drivers: Why Demand Is Rising

Operational Efficiency & Load Stability

Growing import-export volumes and supply-chain modernization have pushed industries to adopt reliable pallet-wrapping solutions. Blown stretch films offer superior:

- Puncture resistance

- Load retention

- Clarity and durability

- Adaptability for irregular loads

These attributes make them indispensable across warehouse operations, cold-chain logistics, and e-commerce distribution.

Innovation in Materials & Extrusion Technology

Manufacturers—both traditional giants and emerging regional producers—are investing in:

- Multi-layer co-extruded films

- Thinner, stronger downgauged films

- Bio-based and recyclable resins

- High-performance LLDPE blends

Technology-forward companies like Berry Global and Amcor are developing sustainable formulations, while new entrants in Asia and Eastern Europe are building competitive advantage in cost-efficient, customizable films.

Surge in Retail & E-commerce

Explosive growth in online retail has reshaped consumption patterns, increasing demand for stretch film in:

- High-volume distribution centers

- Courier and parcel logistics

- Fragile goods protection

E-commerce-heavy countries like China, India, and the UK continue to drive market momentum.

Segmental Insights

Machine Stretch Film Leads with 56% Share (2025)

Machine-grade films dominate due to:

- High-speed automated wrapping

- Uniform containment forces

- Reduced labor costs

- Material optimization

Large distribution hubs and industrial plants increasingly rely on machine stretch technologies developed by both major players and innovative regional SMEs.

LLDPE Material Type Dominates with 52.40% Share (2025)

LLDPE remains the preferred choice because of:

- Superior tensile strength

- High stretch and load integrity

- Recyclability and downgauging compatibility

- Enhanced clarity and cling

Startups focusing on advanced metallocene resins and recyclable LLDPE blends are gaining traction.

21–40 Micron Thickness Segment (45.50% Share)

This versatile range supports medium to heavy loads and aligns with sustainability objectives by reducing material waste.

Challenges: Raw Material Volatility & Sustainability Regulations

Despite strong momentum, the industry faces:

- Price volatility in petrochemical-based resins

- Regulatory scrutiny of plastics, especially single-use packaging

- Limited recycling infrastructure in emerging economies

These factors encourage manufacturers to diversify supply sources and invest in circular packaging solutions.

Opportunities: Advanced Film Structures & Customization

Emerging opportunities include:

- High-performance multi-layer films

- Films tailored for fresh food, pharma, or heavy machinery

- Biodegradable and bio-based formulations

- Ultra-thin but high-strength downgauged films

- Automation-friendly packaging rolls

This opens doors for mid-sized manufacturers aiming to scale production and expand globally.

Regional & Country Outlook

China – Market Leader (5.0% CAGR)

- Rapid e-commerce expansion

- Strong industrial base

- High adoption of load stabilization films

- Large domestic manufacturing ecosystem

India – High-growth Opportunity (4.6% CAGR)

- Expanding retail and FMCG industry

- Increasing need for secure, affordable packaging

- Growing presence of regional film converters

France – European Growth Engine (3.9% CAGR)

- Strong retail and food-processing sector

- Automation fueling demand for durable films

United Kingdom & USA

Moderate yet steady growth due to:

- Investments in automation

- Emphasis on high-performance sustainable films

Competitive Landscape: Established Leaders & Emerging Innovators

Major manufacturers such as Berry Global, Sealed Air, Amcor, Sigma Plastics and AEP Industries continue to dominate through scale, R&D, and global distribution.

However, emerging producers across China, India, Vietnam, Turkey, and Eastern Europe are rapidly modernizing plants, adopting European co-extrusion lines, and developing customized, competitive solutions.

Why FMI: https://www.futuremarketinsights.com/why-fmi

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.