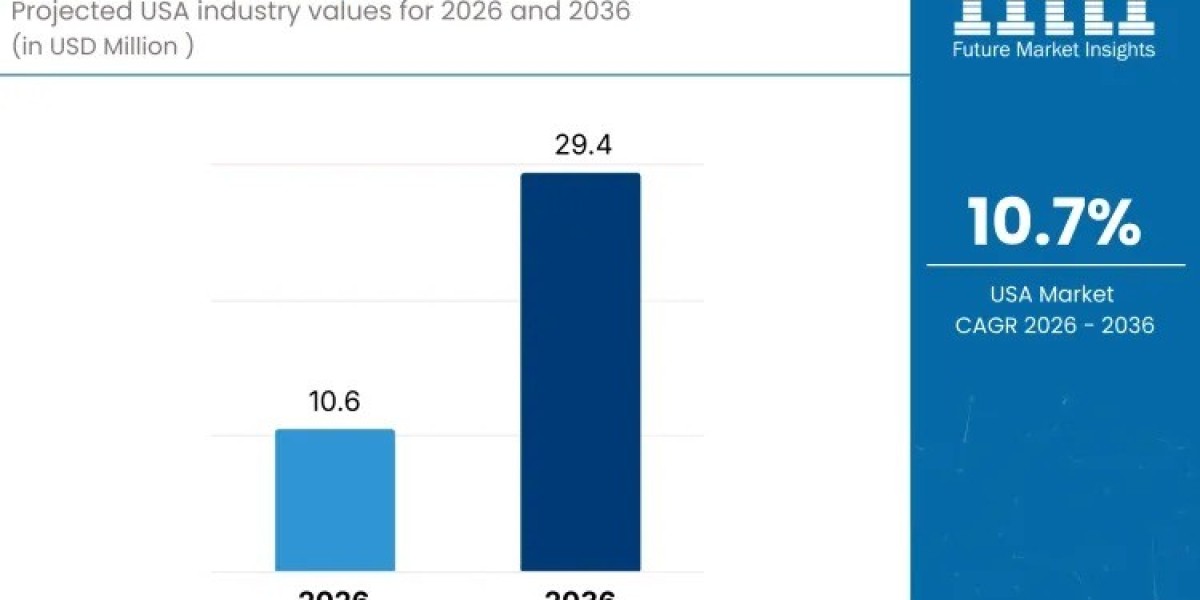

The Demand for VRF systems in the USA is entering a sustained expansion phase, supported by energy efficiency mandates and modernization of building stock. The U.S. VRF systems market is valued at USD 10.6 million in 2026 and is projected to reach USD 29.4 million by 2036, registering a compound annual growth rate (CAGR) of 10.7%.

This growth reflects increasing adoption across commercial buildings, healthcare facilities, and multi-family residential developments, where precise zone-level temperature control and reduced operating costs are critical. Replacement of aging HVAC systems, electrification initiatives, and tighter building energy codes continue to reinforce installation activity in both new construction and retrofit projects.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates: https://www.futuremarketinsights.com/reports/sample/rep-gb-29922

Technology Shift: Heat Pump VRF Systems Lead Adoption

Heat pump systems represent the largest system-type segment, accounting for 55.0% of total U.S. demand. These systems provide both heating and cooling using reversible refrigerant cycles, aligning with electrification goals and reduced reliance on fossil fuels.

Key advantages driving adoption include:

- Simultaneous heating and cooling across multiple zones

- High seasonal energy efficiency and part-load performance

- Lower carbon intensity compared with gas-based systems

Advances in inverter-driven compressors, refrigerant management, and smart control platforms further enhance system reliability and adaptability across diverse U.S. climate conditions.

Component Demand: Outdoor Units Drive Market Value

By component, outdoor units hold a 32.0% share, making them the largest value contributor in the U.S. VRF market. These units integrate compressors, heat exchangers, and inverter technologies that determine overall system capacity and efficiency.

- Outdoor units command higher capital value due to engineering complexity

- Indoor units support zoning flexibility and occupant comfort

- Control systems enable centralized monitoring and energy optimization

This component mix reflects the concentration of system value and performance determinants in outdoor VRF assemblies.

End-User Trends: Residential Segment Takes the Lead

Residential applications account for 49.0% of total demand, led by multi-family housing and high-end residential projects. Developers and homeowners favor VRF systems for quiet operation, individualized comfort, and compatibility with energy-efficiency incentives.

Commercial buildings follow closely, using VRF to manage variable occupancy patterns in offices, hospitality, healthcare, and mixed-use developments. Industrial usage remains selective, largely limited to offices and controlled environments within larger facilities.

Regulatory and Retrofit Drivers Supporting Adoption

Adoption of VRF systems in the U.S. is closely tied to energy efficiency regulations and building modernization efforts. Variable refrigerant flow technology enables precise load matching, helping owners meet state and city performance standards aimed at reducing HVAC energy consumption.

Key adoption drivers include:

- Replacement of aging rooftop units in commercial retrofits

- Limited ductwork requirements in space-constrained buildings

- Electrification policies in states such as California and New York

- Utility incentive programs tied to measured efficiency gains

Healthcare facilities, hotels, and multi-family projects increasingly select VRF systems for quiet operation and zone-level control.

Cost and Complexity: Barriers That Shape Demand Patterns

Despite strong growth, VRF adoption faces challenges. Higher upfront installation costs compared with conventional HVAC systems influence decision-making in cost-sensitive projects. Installation requires specialized contractor training for refrigerant piping, controls integration, and commissioning.

Additional factors affecting demand stability include:

- Skilled labor shortages extending project timelines

- Retrofit complexity in older buildings with limited electrical capacity

- Long-term service availability and proprietary control systems

- Ongoing evaluation of refrigerant regulations

As a result, demand remains strongest in large urban markets where efficiency mandates and lifecycle cost savings justify system complexity.

Regional Outlook: West and South USA Lead Growth

Demand growth varies by region, shaped by climate, regulation, and construction activity.

- West USA leads with a 12.3% CAGR, driven by decarbonization mandates, electrification policies, and high adoption in mixed-use and high-rise developments.

- South USA follows at 11.1% CAGR, supported by cooling-intensive climates, long operating hours, and commercial construction growth.

- Northeast USA records 9.9% CAGR, driven by retrofit activity, urban space constraints, and cold-climate VRF heat pump adoption.

- Midwest USA posts 8.6% CAGR, reflecting gradual penetration in institutional and campus-based projects with a focus on lifecycle cost evaluation.

Competitive Landscape: Focus on Service Depth and Compliance

The U.S. VRF systems market is anchored by established manufacturers including Daikin Applied, Mitsubishi Electric Trane HVAC, LG Air Conditioning Technologies, Samsung HVAC America, and Toshiba Carrier Corporation. Competitive positioning centers on compliance with local codes, breadth of installer training programs, system reliability, and aftersales service capability.

Manufacturers continue to expand product portfolios, integrate advanced controls, and strengthen contractor support to align with evolving efficiency standards and building performance requirements across the U.S.

Outlook

Between 2026 and 2036, demand for VRF systems in the USA will be shaped by electrification, retrofit-driven upgrades, and the need for flexible, energy-efficient HVAC solutions. As regulations tighten and building owners prioritize operating cost reductions, VRF technology is positioned as a core component of next-generation HVAC strategies nationwide.