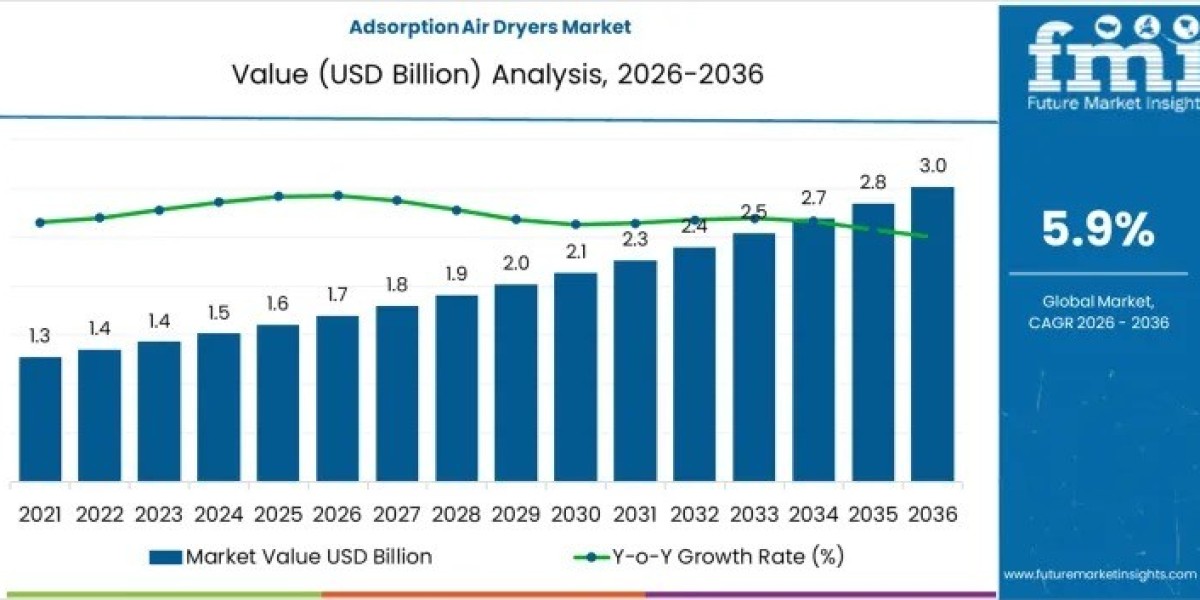

The global Adsorption Air Dryers Market is projected to expand from USD 1.7 billion in 2026 to USD 3.0 billion by 2036, registering a CAGR of 5.9%. Growth is driven by industries where compressed air quality directly impacts product integrity, regulatory compliance, and equipment reliability. Unlike general utility upgrades, adsorption air dryers are specified when moisture poses a measurable operational risk.

Pharmaceutical manufacturing, electronics assembly, food processing, and advanced materials production dominate demand across East Asia, Western Europe, and parts of North America. Adoption remains selective, as many industries continue to operate effectively with refrigerated or simpler drying technologies. As a result, market expansion is shaped by process sensitivity rather than broad industrial growth.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates

https://www.futuremarketinsights.com/reports/sample/rep-gb-30967

Technology Trends Defining Market Structure

Adsorption air dryers are chosen for their ability to achieve ultra-low dew points that conventional systems cannot reliably deliver. Modern designs emphasize operational stability, automation, and predictable moisture control.

Key technology dynamics include:

- Heatless desiccant dryers account for approximately 46% of installations, favored for mechanical simplicity and ease of integration.

- Minus 40 °C dew point systems represent around 48% of demand, balancing moisture protection with manageable operating costs.

- Heated and blower purge dryers are adopted in large continuous-duty plants where energy optimization outweighs added system complexity.

Manufacturers increasingly evaluate total lifecycle cost rather than upfront pricing alone, shifting competitive focus toward efficiency, serviceability, and system uptime.

Regional Growth Patterns Reflect Industrial Priorities

Market growth varies significantly by geography, reflecting industrial maturity and manufacturing specialization.

High-growth regions include:

- India (CAGR 6.7%) – Expansion of automotive, chemical, and pharmaceutical clusters drives demand for moisture-controlled compressed air.

- China (CAGR 6.0%) – Electronics, heavy machinery, and automotive production require consistent dew point control.

- Mexico (CAGR 5.2%) – Automotive and electronics manufacturing hubs increasingly specify adsorption dryers for assembly reliability.

Mature markets show steady replacement demand:

- United States (CAGR 3.6%) – Growth centers on system upgrades and energy-efficient replacements.

- Germany (CAGR 3.1%) – Precision engineering and automotive sectors emphasize reliability and EU compliance.

Why Adsorption Air Dryers Remain Essential

Adsorption air dryers are critical where moisture contamination leads to corrosion, freezing, or product defects. Once a production line is qualified to a specific air quality standard, the drying technology becomes fixed for the life of the process.

Key adoption drivers include:

- Protection of pneumatic tools, valves, and instrumentation

- Compliance with pharmaceutical and food safety regulations

- Prevention of condensation in cold or outdoor installations

- Assurance of uninterrupted production and quality consistency

For many operators, adsorption dryers are treated as risk-mitigation investments rather than efficiency upgrades.

Operational Challenges Limit Universal Adoption

Despite their advantages, adsorption air dryers carry higher ownership costs due to purge air losses, regeneration energy use, and maintenance requirements. Poorly maintained systems can waste compressed air without immediate visibility, making operational discipline critical.

As a result, many facilities deploy adsorption dryers selectively—serving critical production lines while using simpler technologies elsewhere. This targeted approach keeps demand focused on applications where moisture control clearly outweighs operating expense.

Evolving Design and Energy Management Practices

Industrial energy management strategies are reshaping adsorption dryer deployment. Demand-controlled regeneration, integration with plant control systems, and modular skid-mounted designs are gaining traction.

Facilities increasingly:

- Monitor compressed air as a major energy consumer

- Synchronize dryer operation with compressor load

- Combine multiple drying technologies within a single plant

This evolution supports smarter, more efficient use rather than blanket system installation.

Competitive Landscape: Performance and Service Define Leadership

Competition in the adsorption air dryers market is defined by dew point stability, system reliability, and application engineering expertise. Leading suppliers include:

- Atlas Copco

- Ingersoll Rand

- Parker Hannifin

- Donaldson Company

- Kaeser Kompressoren

- SPX FLOW

- Beko Technologies

- Gardner Denver

- Sullair (Hitachi)

- Regional OEMs

Suppliers that combine proven performance with strong service networks and compliance support maintain long-term relevance.

Market Outlook Through 2036

By 2036, adsorption air dryers are expected to remain indispensable in moisture-sensitive manufacturing. Growth will be driven by tighter process specifications, expansion of precision industries, and increasing focus on lifecycle cost optimization rather than mass replacement of existing systems.